Why is Bitcoin price up today?

Bitcoin Price Insights:

Bitcoin (BTC) price has hit a new yearly peak in each of the last three consecutive weeks. Investors anticipate that BTC will cross $39,000 next week.

Bullish holders shifted 30,000 BTC into crypto exchange wallets, signaling a possible profit-taking session in the coming week.

The daily Relative Strength Index (RSI) shows that BTC is approaching overbought territory.

Bitcoin’s (BTC) price grazed $38,000 last week as the bulls extended the 2023 peak by another 7% on Thursday, November 9, 2023. In-depth data analysis examines how recent on-chain movements by Bitcoin holders could impact BTC price action in the coming week.

Bitcoin Holders Deposited 30,000 BTC on Crypto Exchanges Over the Weekend.

Bitcoin price climbed to a new 2023 peak of $37,900 on November 9, when news of the SEC approving a number of Spot ETF applications hit the newsreels last week. A lot of corporate institutions and whale investors were spotted buying up large amounts of BTC and shifting them into long-term storage wallets.

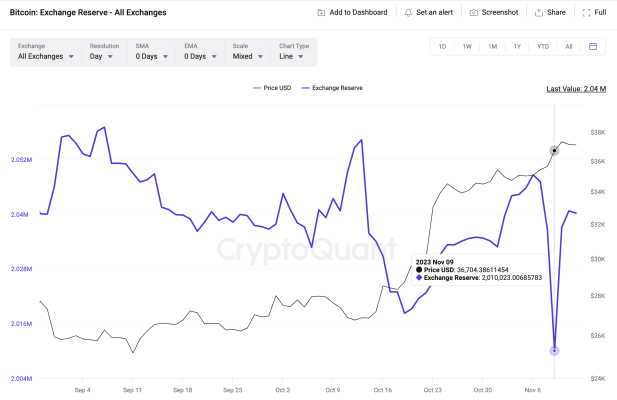

However, as the bullish impact of the news saturated, on-chain data shows that some BTC investors are moving to lock in some quick profits. CryptoQuant’s BTC Exchange Reserves data shows that some BTC holders deposited a significant amount of BTC into their exchange wallets over the weekend.

As depicted below, the Bitcoin Exchange Reserves stood at 2.01 million BTC when the price hit $38,000 on Thursday. But as of Sunday November 12, it has increased to 2.04 million BTC.

This means that Bitcoin holders have deposited 30,000 BTC across different crypto exchanges, over the weekend alone. When valued at the current BTC price of $37,200 the newly-deposited coins will add approximately $1.2 billion to Bitcoin market supply.

Bitcoin (BTC) Exchange Reserves vs. Price | Source: CryptoQuant

The Exchange Reserves metric depicted above, tracks real-time changes in the number of BTC coins deposited on crypto exchanges and trading platforms. Typically, it is a bearish signal when exchange supply increases and vice versa.

Firstly, an increase in Exchange Reserves, as observed above, indicates that more investors are looking to explore short-term trading opportunities, than those opting for long-term storage.

Secondly, increasing Bitcoin deposits across crypto spot trading platforms and exchanges effectively dilutes the market supply.

Hence, without a corresponding increase in Bitcoin market demand this week, the additional $1.2 billion (30,000 BTC) deposited on exchanges over the weekend could trigger a price pull-back in the days ahead.

Bitcoin Price Forecast: The Bulls Could Endure a Consolidation Phase

The rising Bitcoin Exchange Reserves suggest that a significant number of BTC holders are considering short-term profit taking opportunities. If the bears keep adding billions of dollars worth of BTC to the market supply, the bulls could eventually succumb to the fatigue.

The daily Relative Strength Index data also corroborates this Bitcoin price forecast. As of November 12, BTC RSI currently stands at 81.69.

Typically, an RSI value greater than 70 is a clear indication that the asset is approaching oversold territory. Hence, with the bulls running out of steam the rising BTC market supply puts the Bitcoin price in danger of a pull-back.

If that happens, the Bitcoin bulls could mount a significant support wall at the 20-day EMA price of $34,780. With the sentiment surrounding the crypto market still firmly bullish, BTC will likely attract buying interest to force a rebound at that range.

However, losing that support level could send BTC price spiraling toward the EMA-50 of $32,000, which is the next significant support territory.

Bitcoin (BTC) Price Forecast: Source: TradingView

On the flip side, the bulls target another yearly high for the 4th consecutive week if BTC receives a boost from another bullish news event. In that case, the current yearly peak of $38,000 will be the initial resistance to beat.

As decisive breakout of the $38,000 resistance could send BTC price above the elusive $40,000 target.

Understanding the Surge in Bitcoin Price Today

In the ever-fluctuating landscape of cryptocurrency, the surge in Bitcoin’s price today has once again sparked curiosity and speculation within the financial sphere. As the pioneer of digital currencies, Bitcoin’s movements often trigger a domino effect across the crypto market and, at times, reverberate in traditional financial markets. Several factors could contribute to the sudden uptick in its value today.

Market Sentiment and Speculation

Market sentiment, often driven by news, events, or global economic factors, significantly influences cryptocurrency prices. Today’s surge could be the result of positive news, potentially signaling widespread adoption or regulatory developments favoring Bitcoin. Speculation, a potent force in the crypto world, could also be driving the surge. Traders and investors may be reacting to perceived opportunities, leading to increased demand and, subsequently, price hikes.

Institutional Interest

The involvement of institutional investors has been a catalyst for Bitcoin’s price surges in the past. Reports of prominent companies or financial institutions embracing Bitcoin as part of their investment portfolio can trigger a wave of positive sentiment. Whether it’s a large corporation adding Bitcoin to its treasury reserves or an investment firm announcing a sizable allocation to digital assets, such news tends to bolster confidence in Bitcoin, potentially boosting its value.

Macro-Economic Factors

Macroeconomic conditions, such as inflation concerns, government policies, or geopolitical tensions, can significantly impact Bitcoin’s price. Economic instability or uncertainty in traditional markets often leads investors to seek alternative assets like Bitcoin, seen by many as a hedge against inflation or a store of value. Today’s surge could reflect growing concerns about fiat currency devaluation or economic turbulence in specific regions, prompting investors to turn to Bitcoin.

Technical Analysis

Technical factors, such as trading volumes, price patterns, and market dynamics, play a crucial role in understanding short-term price movements. Traders and algorithms that follow technical analysis might have triggered buying or selling at specific price points or patterns, potentially contributing to the surge. Additionally, factors like liquidation of short positions or the activation of stop-loss orders could have triggered a rapid increase in demand, propelling the price upward.

Global Adoption and Regulation

Global adoption and regulatory developments significantly impact the cryptocurrency market. Positive news about a country legalizing or embracing cryptocurrencies, or major developments in regulatory clarity, can drive prices upward. Conversely, negative news, like regulatory crackdowns or bans, can lead to price drops. Today’s surge in Bitcoin’s price might be a response to progressive regulatory frameworks or increased adoption in various parts of the world.

Cryptocurrency Market Dynamics

Bitcoin’s price movements often influence other cryptocurrencies. Today’s surge might not be exclusive to Bitcoin but could reflect a broader trend in the cryptocurrency market. Altcoins might also experience price hikes as traders and investors diversify their portfolios in response to Bitcoin’s surge, contributing to an overall upturn in the market.

In conclusion, the surge in Bitcoin’s price today is likely the result of a combination of factors—sentiment, institutional interest, macroeconomic conditions, technical analysis, global adoption, and broader cryptocurrency market dynamics. As the cryptocurrency landscape continues to evolve, understanding these diverse factors is crucial in comprehending the reasons behind sudden price surges. While the specific trigger for today’s increase may remain elusive, these underlying influences provide a framework for interpreting and analyzing the complex movements of Bitcoin and the wider cryptocurrency market.