Analyst Suggests Bitcoin’s 14% Weekly Surge Marks the ‘End of an Era’ as Major Tech Companies Divest

The recent uptick in Bitcoin’s value, combined with gains seen across all sectors of digital assets, serves as a clear indicator of the extensive cryptocurrency rally.

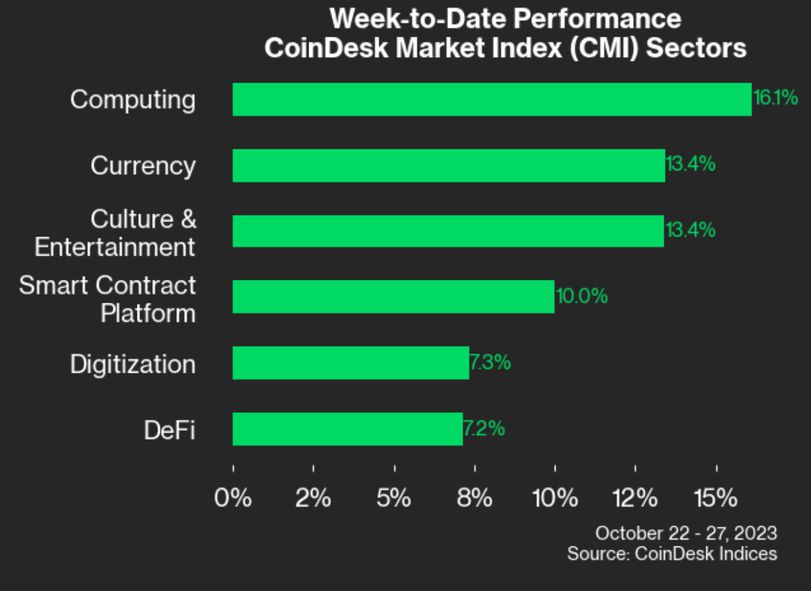

Data from CoinDesk reveals that Bitcoin (BTC) has not only enjoyed a surge in price this week but has also prompted gains across the broader cryptocurrency market. In just one week, BTC witnessed an increase of over 14%, stabilizing at around $33,700 after reaching its highest annual point at $35,000, although it couldn’t break through that threshold. Bitcoin’s performance aligns closely with the 14% increase seen in the CoinDesk Market Index (CMI).

Remarkably, the CoinDesk Computing Sector (CPU), an index tracking protocols focused on constructing and supporting Web3 infrastructure and distributed computing, demonstrated the most significant gains. The CPU sector surged by over 17%, primarily driven by the success of tokens like Chainlink (LINK) and Fetch.AI (FET).

Even sectors that had previously lagged behind, such as decentralized finance (DCF) and digitization (DTZ), saw an increase of over 7% this week, underscoring the breadth of the cryptocurrency rally.

Noteworthy performers in the cryptocurrency market included the infamous meme coin pepe (PEPE), which saw a 76% surge after a token burn, LINK, which gained over 44% due to the trend of real-world asset tokenization, and Injective Protocol’s native token (INJ), adding an additional 58% to its impressive performance following a token upgrade in August.

Crypto’s ‘Uptober’ and the Decline of Big Tech

What adds to the significance of this bullish week in the cryptocurrency market is the underwhelming performance of U.S. equities, as pointed out by Coinbase analysts David Duong and David Han.

According to their report, BTC experienced a significant 4.3 standard deviation increase in performance compared to the past three months, while the S&P 500 and Nasdaq saw a decrease of nearly 2.5 to 3.0 standard deviations during the same period.

Duong and Han stated, “This substantial divergence partially reflects a deteriorating macro trading environment in contrast to Bitcoin’s positive idiosyncratic narrative.”

“Uptober” is indeed living up to its name, as noted by Charlie Morris, the founder of investment advisory firm ByteTree, in a Friday market update. Morris pointed out that the Nasdaq, which is heavily tech-focused, is experiencing a decline while Bitcoin and gold are advancing. This signals a shift in the investment landscape away from the ever-expanding, large U.S. tech corporations.

“Big tech is currently overpriced, and following underwhelming results this week, the sector no longer exhibits the rapid growth necessary to justify premium prices,” Morris explained. “Though they had room to cut costs, true growth comes from increasing sales rather than reducing expenses.”

Why is Bitcoin Price Up Today? Analyzing the Factors Behind the Surge

Introduction

Bitcoin, the world’s most renowned cryptocurrency, has exhibited remarkable price volatility in recent years. Today, the digital asset is experiencing another surge in value, leaving investors and enthusiasts alike to ponder the reasons behind this latest price increase. This article will delve into the factors that have contributed to Bitcoin’s price surge, shedding light on the key drivers behind its current upward trajectory.

Institutional Investment

One of the most significant factors driving Bitcoin’s price up today is the continued influx of institutional investment. Institutional players, including prominent investment firms, corporations, and even governments, have recognized the potential of cryptocurrencies as a store of value and an investment asset. Notable companies like Tesla and Square have allocated significant portions of their treasury reserves to Bitcoin. These endorsements from influential corporations have encouraged more investors to consider Bitcoin as a legitimate asset class.

Growing Acceptance

Bitcoin’s growing acceptance as a means of payment and store of value has boosted its price. Increasingly, mainstream companies and online retailers are accepting Bitcoin as a method of payment. This acceptance not only legitimizes the cryptocurrency but also enhances its utility, contributing to its attractiveness as an investment.

Supply Scarcity

Bitcoin’s price surge can also be attributed to its fixed supply. Bitcoin operates on a capped supply of 21 million coins, which creates scarcity and potentially drives up demand. As Bitcoin becomes more challenging to mine, the cost of acquisition rises, further bolstering its value. This scarcity factor has attracted both long-term investors looking to preserve wealth and traders aiming to capitalize on the asset’s growth potential.

Safe-Haven Asset

In times of economic uncertainty and geopolitical instability, Bitcoin is increasingly seen as a safe-haven asset, much like gold. Investors turn to Bitcoin as a hedge against currency devaluation and economic turmoil. With global events such as the COVID-19 pandemic and inflation concerns, the appeal of Bitcoin as a safe-haven asset has grown, driving its price upward.

Institutional Support

The endorsement and participation of well-established financial institutions have played a pivotal role in the recent surge. Traditional banks and investment firms are offering Bitcoin investment products, making it easier for their clients to gain exposure to the cryptocurrency market. Moreover, regulatory clarity has improved, providing institutions with a more secure environment in which to invest.

Positive Market Sentiment

Market sentiment plays a crucial role in the price movement of Bitcoin. Positive news, developments, and endorsements can create a surge in buying activity, driving prices up. Recently, Bitcoin has received positive attention from influential figures in finance and technology, further boosting market sentiment. These endorsements and positive narratives have contributed to the current price increase.

Technological Advancements

Ongoing technological advancements and improvements within the Bitcoin ecosystem have positively impacted its price. For instance, the integration of the Lightning Network has enhanced transaction speeds and lowered fees, making Bitcoin more attractive for everyday use. Additionally, increased security measures and scalability solutions have instilled confidence in investors.

Global Adoption

Bitcoin’s global adoption has been steadily growing, with countries like El Salvador officially recognizing it as legal tender. This type of recognition by governments and nations opens up new markets and creates fresh demand for Bitcoin, which translates to higher prices.

Trading Activity

Trading activity, including both spot and derivatives markets, plays a significant role in determining Bitcoin’s price. Increased trading volume, particularly in major cryptocurrency exchanges, can lead to heightened price volatility and surges. Traders looking for profit opportunities have contributed to the recent price increase through their speculative activities.

Speculative Nature

Bitcoin’s price is also influenced by speculation. Many investors are drawn to cryptocurrencies with the hope of significant returns, which can lead to frenzied buying and selling. Speculation, although volatile, has the potential to propel Bitcoin’s price upwards, albeit with greater risk.

Conclusion

The surge in Bitcoin’s price today can be attributed to a combination of factors, including institutional investment, growing acceptance, supply scarcity, safe-haven status, institutional support, positive market sentiment, technological advancements, global adoption, trading activity, and speculative interest. Understanding these driving forces is essential for both seasoned investors and newcomers in the cryptocurrency market. As Bitcoin’s role in the global financial landscape continues to evolve, its price dynamics will remain a subject of fascination and discussion in the financial world.