Bitcoin Nears ‘Supply Shock’ with 5-Year Low in Exchange Balances, Analyst Suggests

According to an interview with CoinDesk TV, Matt Weller, the global head of research at Forex.com, has highlighted that Bitcoin’s (BTC) supply is becoming increasingly limited due to exchange balances dropping to a five-year low. This situation sets the stage for a possible “supply shock.”

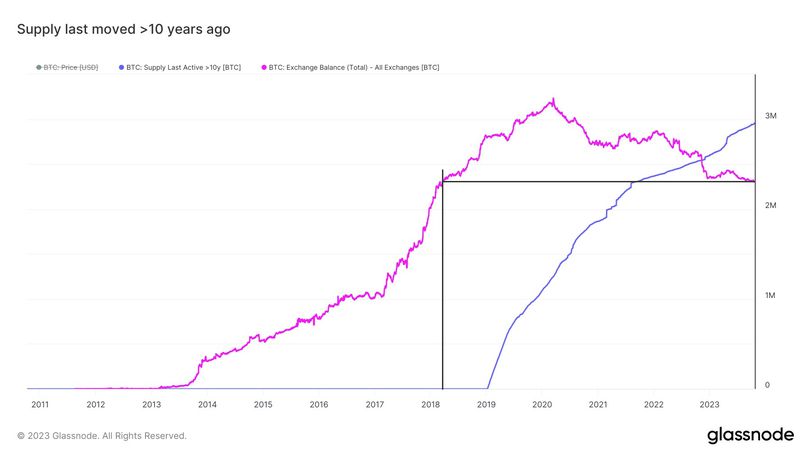

Data from Glassnode indicates that the amount of available Bitcoin on cryptocurrency exchanges, which refers to the liquid tokens that investors can easily buy and sell, has decreased by 2.3 million. This is the lowest reading since April 2018, down from 2.6 million a year ago and 3.2 million at its peak in May 2020.

Furthermore, Weller pointed out that approximately 3 million Bitcoin tokens have remained untouched for a decade. This is in comparison to the current overall supply of 19.5 million and Bitcoin’s maximum supply of 21 million.

Weller commented on this situation, stating, “This suggests a potential supply shock. With reduced supply in the market, even a slight increase in demand could lead to a rapid surge in prices.”

Weller also mentioned that spot exchange-traded funds (ETFs) could have a profound impact on Bitcoin’s supply and demand dynamics, especially in contrast to futures-based products. These spot ETFs could open the door to a new set of investors. He emphasized that this is particularly significant now as Bitcoin has regained its status as an “uncorrelated asset,” having decoupled from equities and rallying while U.S. stocks have entered correction territory.

Why is Bitcoin Price Up Today? A Comprehensive Analysis

Introduction

Bitcoin’s price is known for its volatility, and its daily fluctuations often leave investors and enthusiasts wondering, “Why is Bitcoin price up today?” In this article, we will delve into some of the key factors driving Bitcoin’s recent price surge, shedding light on the cryptocurrency market’s ever-changing dynamics.

Institutional Adoption

One of the most significant factors contributing to the recent surge in Bitcoin’s price is institutional adoption. Large financial institutions, hedge funds, and corporations have been increasingly allocating a portion of their portfolios to Bitcoin. This trend started with companies like Tesla and Square investing in Bitcoin and has continued to gain momentum.

The endorsement of cryptocurrencies by influential figures like Elon Musk and Michael Saylor has further bolstered institutional confidence in Bitcoin. The appeal of Bitcoin as a store of value, a hedge against inflation, and a portfolio diversifier has made it an attractive asset for these institutions.

Macro Economic Factors

Global economic uncertainty and the impact of central bank policies have played a vital role in Bitcoin’s price appreciation. The ongoing COVID-19 pandemic and unprecedented monetary stimulus measures have raised concerns about currency devaluation and inflation.

As a result, Bitcoin has been embraced as a digital alternative to traditional fiat currencies. Investors view it as a safe haven asset that can potentially protect their wealth in times of economic turmoil. The desire to escape fiat currency devaluation has driven an influx of funds into Bitcoin.

Regulatory Developments

The regulatory environment for cryptocurrencies has been evolving rapidly. While it can pose risks, it also offers the potential for greater legitimacy and broader adoption. In recent times, regulatory clarity has emerged as a driving force behind Bitcoin’s price rise.

Efforts to regulate and legitimize the crypto market have given institutional investors more confidence in participating. Clearer rules and oversight provide a sense of security that was previously lacking, making Bitcoin an attractive investment option for a wider range of investors.

Technological Advancements

Bitcoin’s underlying technology, blockchain, continues to evolve. Developers are constantly working on improving scalability, security, and overall network efficiency. These advancements have not only improved the Bitcoin network but have also reinforced confidence in the cryptocurrency.

Layer-2 solutions like the Lightning Network and Segregated Witness (SegWit) have enhanced transaction speed and lowered fees, making Bitcoin more practical for everyday use. As the technology behind Bitcoin matures, it becomes more appealing to a broader audience.

Scarcity and Halving Events

Bitcoin’s scarcity is a fundamental element contributing to its price appreciation. With a fixed supply capped at 21 million coins, Bitcoin becomes more valuable as demand increases. The halving events, which occur approximately every four years, reduce the rate at which new Bitcoins are created.

The most recent halving in May 2020 reduced the block rewards from 12.5 to 6.25 Bitcoins, further diminishing the available supply. This reduction in supply has historically been associated with significant price rallies as it emphasizes Bitcoin’s deflationary nature.

Speculative Trading and Media Hype

Speculative trading and media coverage also play a significant role in Bitcoin’s price movements. News reports, social media discussions, and celebrity endorsements can create hype and drive increased demand. Speculative traders often follow these trends, causing price fluctuations.

The “fear of missing out” (FOMO) is a common psychological factor among retail investors. When they witness significant price gains, they rush to invest in Bitcoin, leading to further price increases. This dynamic can be a double-edged sword, contributing to both rapid gains and sudden drops.

Increased Retail Participation

Retail investors are increasingly participating in the cryptocurrency market. User-friendly platforms and mobile apps have made it easier for individuals to buy, hold, and trade Bitcoin. Retail investors seeking exposure to potential high returns have flocked to the cryptocurrency space.

The cumulative effect of numerous small investments can have a substantial impact on Bitcoin’s price. Retail traders are more likely to buy during price surges, driving up demand.

Conclusion

The question of why Bitcoin’s price is up today can be answered by considering a combination of factors. Institutional adoption, macroeconomic conditions, regulatory developments, technological advancements, scarcity, speculative trading, media coverage, and retail participation are all intertwined in shaping Bitcoin’s price trajectory.

While these factors contribute to Bitcoin’s recent price gains, it’s essential to remember that the cryptocurrency market remains highly speculative and volatile. Prices can fluctuate rapidly in both directions, and investors should approach the market with caution and a long-term perspective. As the cryptocurrency ecosystem continues to evolve, monitoring these key factors is crucial for understanding the dynamics of Bitcoin’s price movements.