Bitcoin has surged above $34,500 on October 30, driven by the potential approval of a spot BTC ETF in the United States and other factors.

To sum it up:

Impressive Growth of BTC: In the year 2023, Bitcoin began at $16,500, and it is now approaching $34,500, with a significant surge in mid-October.

Rumors of SEC Approval: Speculation about the SEC giving the green light to BlackRock’s BTC ETF application sparked market excitement. While a previous report was proven false, the listing of BTC with the Depository Trust & Clearing Corporation renewed hopes.

Positive Investor Sentiment: The overall bullish atmosphere and the prospect of ETF approval pushed the Fear and Greed Index to indicate “Greed.”

BTC’s Target of $35K: The largest cryptocurrency has performed impressively throughout 2023, with its value surging from around $16,500 at the start of the year to approximately $34,500 according to CoinGecko data, marking a 110% increase.

Notably, this rapid increase occurred earlier in October, when BTC was trading at less than $27,000. Several developments and positive news played a role in the substantial rise in the following days.

Potential Reasons: The primary driver of Bitcoin’s recent strong performance could be the circulating rumors that the United States Securities and Exchange Commission (SEC) is nearing approval of BlackRock’s application to launch a spot BTC ETF in the U.S.

Two weeks ago, the asset’s value shot up over 10% in just minutes following a report suggesting regulatory approval. However, this information turned out to be incorrect, and BTC retraced to around $28,000. Despite the absence of a spot Bitcoin ETF in the U.S., its listing with the Depository Trust & Clearing Corporation led some to believe that regulatory approval was imminent.

These factors, along with the overall bullish sentiment in the cryptocurrency market, have contributed to the recent increase in Bitcoin’s value. Investor confidence and interest in the asset have rebounded, with the Fear and Greed Index indicating “Greed” for the past week, a level not seen since the beginning of the year.

In Brief:

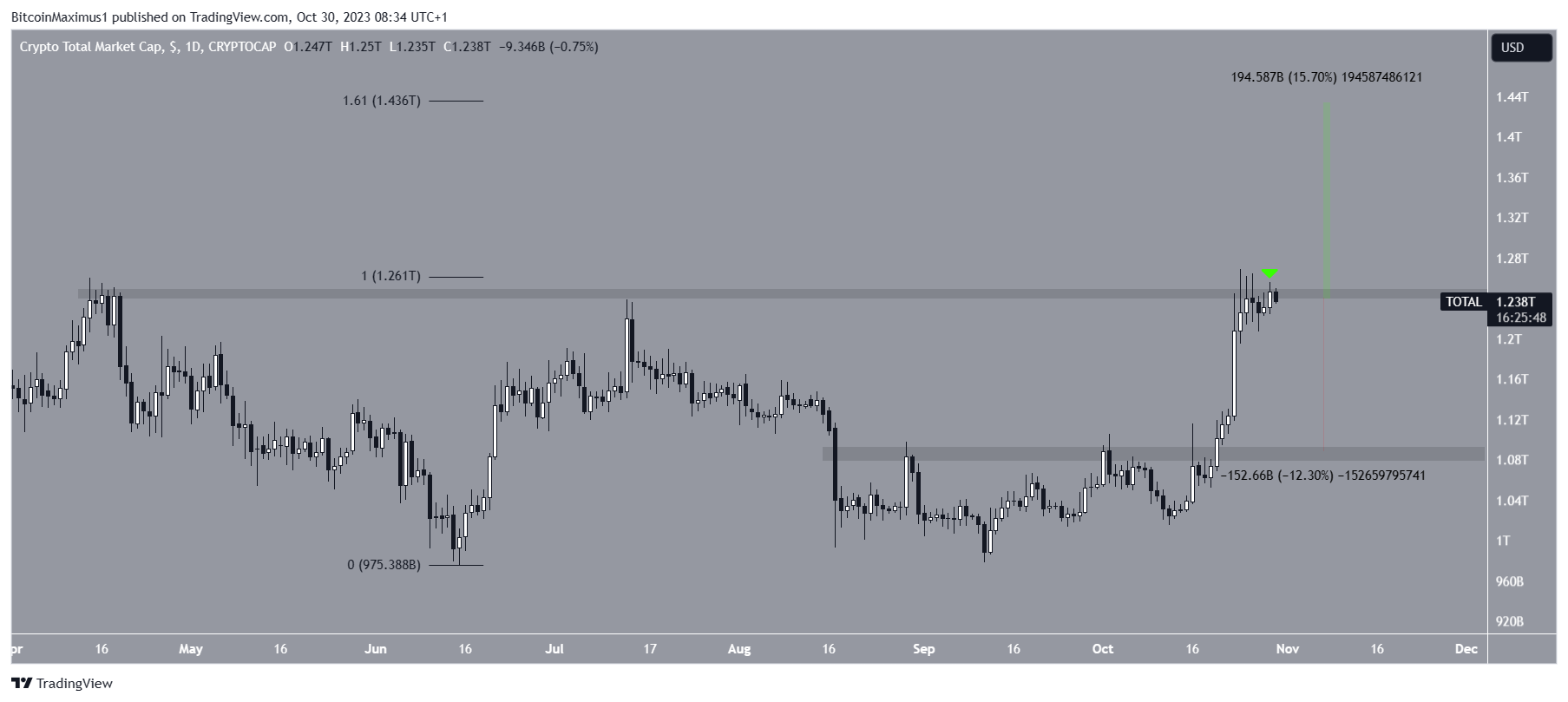

- The Crypto Market Cap (TOTALCAP) is attempting to break through the $1.25 trillion resistance area, which has held since April.

- Bitcoin (BTC) achieved its highest weekly close in 550 days last week, breaking free from the $30,500 resistance area.

- Axie Infinity (AXS) broke free from a long-term descending resistance trendline on October 21, reaching a peak of $6.

Elon Musk has introduced a new policy to combat the spread of misinformation on X, with users who post deceptive content no longer receiving engagement-based payments.

Crypto asset management firm VanEck holds an optimistic prediction that Solana (SOL) could surpass $3,000.

Struggles with Long-Term Resistance for TOTALCAP: Despite its rapid rise since October 12, TOTALCAP reached a yearly high of $1.27 trillion on October 24 but subsequently fell below the crucial $1.25 trillion resistance area, which has been in place since April. The future trend hinges on whether the price can break out from this level or faces rejection.

Highest Weekly Close for Bitcoin: Bitcoin’s price saw a significant increase last week, reaching a new annual high of $35,280 and breaking the $30,500 resistance area that had been in place since May 2022. The weekly close at $34,525 is the highest in 550 days, dating back to April 2022.

AXS Hits $6: The price of Axie Infinity (AXS) has risen rapidly since breaking free from a descending resistance trendline on October 21. In just nine days, AXS has surged by 33%, reaching a high of $6.

Similar to BTC, the daily RSI for AXS is on the rise and above 50, supporting this upward trend. If the momentum continues, AXS could reach the $6.70 resistance area, which is 15% above its current price. However, a failure to sustain this increase could result in a 17% drop to the nearest support at $4.80.

Why is Bitcoin Price Up Today?

Introduction

Bitcoin, the world’s most renowned cryptocurrency, is known for its notorious price volatility. On any given day, the price of Bitcoin can experience significant fluctuations. Therefore, when Bitcoin’s price experiences a notable increase, it inevitably piques the interest of investors, traders, and the general public. In this article, we will delve into the reasons behind the recent surge in Bitcoin’s price.

The Global Financial Landscape

One of the primary factors contributing to the rise in Bitcoin’s price is the broader global financial landscape. Geopolitical tensions, economic uncertainties, and central bank policies have played a significant role in boosting Bitcoin’s appeal as a store of value. In times of crisis, investors often turn to non-traditional assets like cryptocurrencies, viewing them as hedges against inflation and market turmoil.

The Role of Institutional Adoption

Institutional adoption of Bitcoin has been a game-changer for the cryptocurrency. High-profile companies, such as Tesla and Square, have allocated significant portions of their balance sheets to Bitcoin. Additionally, the approval of Bitcoin Exchange-Traded Funds (ETFs) in several countries, including the United States, has made it easier for institutional investors to access Bitcoin. This growing institutional interest has bolstered confidence in the cryptocurrency market.

Market Sentiment

Market sentiment plays a crucial role in influencing the price of Bitcoin. Positive news and developments in the cryptocurrency ecosystem can lead to a surge in investor confidence. For example, rumors of regulatory approval for Bitcoin-related financial products, like ETFs, often trigger bullish sentiment. A positive Fear and Greed Index, which measures market sentiment, can be a leading indicator of price increases.

Bitcoin Halving

Bitcoin operates on a predefined supply schedule. Every four years, a phenomenon known as the “halving” occurs, reducing the rewards for Bitcoin miners by half. This scarcity-driven event has historically led to surges in the price of Bitcoin. The most recent Bitcoin halving took place in May 2020, and its effects on supply and demand dynamics are still being felt in the market.

Speculation and Trading Activity

Speculation and trading activity can create short-term price spikes. Traders and investors often buy and sell Bitcoin in reaction to market news and price trends. The use of leverage and margin trading can also amplify these movements. High trading volumes and increased liquidity can lead to rapid price fluctuations, which, in turn, can attract more participants to the market.

Technological Developments

Technological advancements in the cryptocurrency space can influence Bitcoin’s price. Developments such as the integration of the Lightning Network, which enhances the scalability and speed of Bitcoin transactions, can boost the utility and adoption of Bitcoin. Similarly, improvements in security and regulatory compliance can make Bitcoin more attractive to both institutional and retail investors.

Market Capitalization

Bitcoin’s market capitalization, often referred to as its “market cap,” is a significant indicator of its overall value. As Bitcoin’s price increases, its market cap also grows. A higher market cap can attract more investors who view Bitcoin as a valuable and established asset. Additionally, a larger market cap can provide a level of price stability, making it more appealing to risk-averse investors.

Global Economic Conditions

Global economic conditions, including inflation and monetary policy, have a profound impact on Bitcoin’s price. The cryptocurrency is often seen as a hedge against inflation, similar to gold. When central banks increase the money supply or implement quantitative easing measures, investors may turn to Bitcoin to preserve the value of their assets. These macroeconomic factors can lead to increased demand for Bitcoin and, subsequently, higher prices.

The Influence of Major Players

Prominent figures and influential players in the cryptocurrency space, such as Elon Musk, can exert considerable influence over Bitcoin’s price. A single tweet or statement from such individuals can lead to rapid price movements. Therefore, it is crucial to monitor the actions and statements of key industry figures to gain insights into potential price developments.

Conclusion

Bitcoin’s price is subject to a myriad of factors, and its daily fluctuations are the result of a complex interplay of forces. In recent times, institutional adoption, global economic conditions, market sentiment, technological advancements, and speculation have all contributed to the surge in Bitcoin’s price. While the cryptocurrency market remains highly unpredictable, understanding these influential factors can provide valuable insights into why Bitcoin’s price is up today. As Bitcoin continues to evolve and mature, its price movements are likely to remain a subject of great interest and speculation in the financial world.