Why is Bitcoin price up today?

Today, the price of Bitcoin has seen an increase, and the rapid surge past $38,000 is evoking bullish sentiments among both retail and institutional investors.

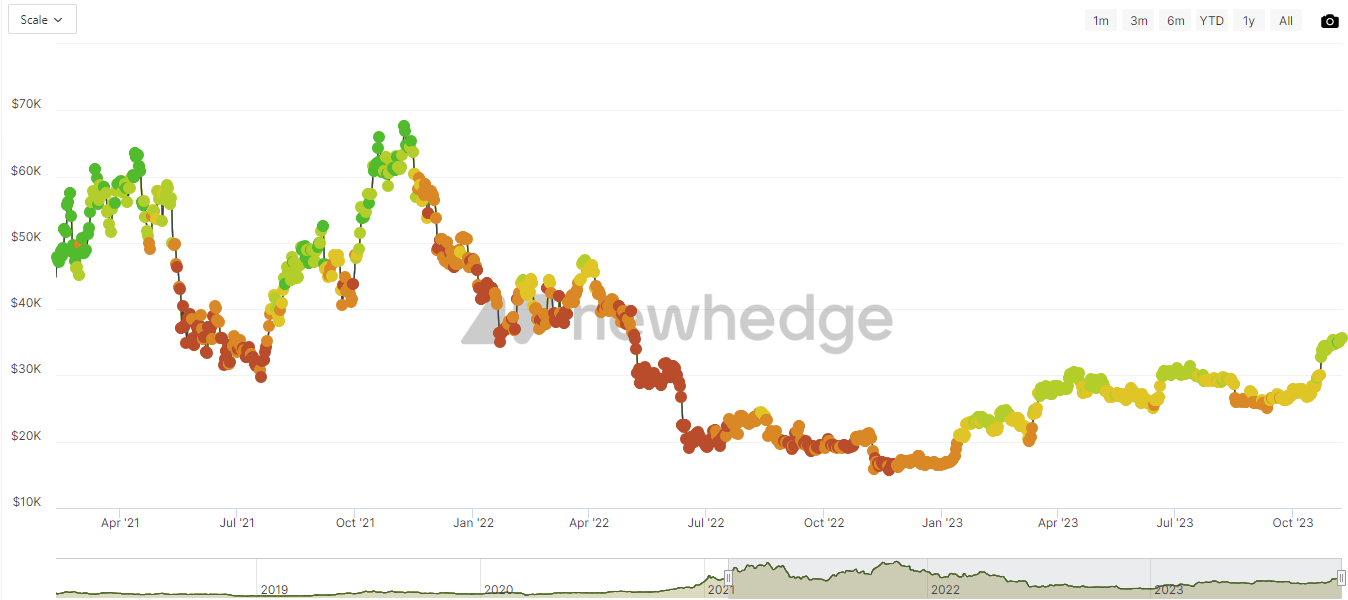

The interest from institutional investors in Bitcoin is contributing to a positive market sentiment. Despite facing various macroeconomic challenges, the price of Bitcoin continues its upward trend, marking a 121% year-to-date gain. Data from the options market indicates that traders are positioning themselves towards the $40,000 level. Over the last two weeks, the movement in price has propelled the Crypto Fear & Greed Index to its highest level since Bitcoin reached its all-time high of $69,789 in November 2021.

In mid-October, there was a flurry of spot Bitcoin ETF amendments, and on Nov. 9, the Securities and Exchange Commission (SEC) opened the first window for approving the 12 outstanding ETFs. Despite multiple applicants, including BlackRock, Fidelity, ARK Invest, and 21Shares, the SEC has yet to approve a spot Bitcoin ETF. The approval window extends until Nov. 17, and if the SEC maintains its pattern of delaying approval, it will remain open until Jan. 10.

Reports suggest that an approval could generate $600 billion in new demand. According to CryptoQuant analysts, an ETF approval could result in a $1 trillion increase in Bitcoin’s market capitalization. Galaxy Digital forecasts a 74% price increase in the first year following the launch of a spot BTC ETF.

As the price of Bitcoin rises, the supply of BTC on exchanges remains below the yearly peak recorded on May 3, 2023. Exchanges have witnessed a reduction of over 200,000 BTC since then. The market interprets the decrease in coins on crypto exchanges as a bullish signal, as traders typically withdraw their BTC for long-term self-custody. On Nov. 7, long-term Bitcoin holders acquired a record 92% of all newly minted BTC.

With Bitcoin consistently leaving exchanges, liquidations are having a significant impact on the price. In the past 24 hours alone, more than $126 million in BTC shorts have been liquidated, with over $74.6 million in shorts being liquidated within a 12-hour timeframe.

The current momentum in Bitcoin’s price is displaying bullish signs, facilitating a breakout from consolidated ranges. Overcoming the crucial resistance levels at $37,000 instills confidence in the upward momentum of Bitcoin’s price. Analysts are now inclined to believe that the upside potential for Bitcoin’s price has been heightened.

Consider preserving this article as an NFT to capture this moment in history and express your support for independent journalism in the crypto space.

Analyzing the Surge: Factors Driving the Current Bitcoin Price Rally

Introduction

In the ever-evolving landscape of cryptocurrency markets, the recent surge in Bitcoin prices has captured the attention of both seasoned investors and casual observers alike. The question on everyone’s mind is, “Why is Bitcoin’s price up today?” This article delves into the multifaceted factors contributing to the current bullish momentum in the Bitcoin market.

Institutional Interest and Market Sentiment

One pivotal factor behind the surge in Bitcoin prices is the growing interest from institutional investors. Despite facing macroeconomic headwinds, Bitcoin has managed to secure a remarkable 121% year-to-date gain. The data from the options market reveals a palpable enthusiasm among traders, with many positioning themselves for a potential breach of the $40,000 level.

The surge in institutional interest is not without precedent. Following a rush of spot Bitcoin ETF amendments in mid-October, the Securities and Exchange Commission (SEC) opened the window for approving 12 outstanding ETFs on November 9. Noteworthy applicants, including BlackRock, Fidelity, ARK Invest, and 21Shares, have sought SEC approval for a spot Bitcoin ETF. As of now, the approval window extends until November 17, and should the SEC persist in delaying approval, it could remain open until January 10.

Potential Impact of ETF Approval

Analysts speculate that an approval of a spot Bitcoin ETF could generate a staggering $600 billion in new demand. According to CryptoQuant analysts, such approval might lead to a monumental $1 trillion increase in Bitcoin’s overall market capitalization. Additionally, Galaxy Digital offers an optimistic projection, forecasting a 74% price increase in the first year post the launch of a spot BTC ETF.

Bitcoin Liquidations and Exchange Dynamics

Simultaneously, as Bitcoin prices experience an upswing, the supply of BTC on exchanges remains below the yearly peak recorded on May 3, 2023. Exchanges have witnessed a substantial reduction of over 200,000 BTC since then. Market participants interpret this reduction in exchange-held coins as a bullish signal, as it suggests that traders are withdrawing their BTC for long-term self-custody.

On November 7, long-term Bitcoin holders made headlines by purchasing an unprecedented 92% of all newly minted BTC. This further reinforces the notion that investors are opting to hold their assets in self-custody, indicating a long-term bullish sentiment among market participants.

Impact of Reduced Exchange Supply on Liquidations

The departure of Bitcoin from exchanges has a notable impact on price dynamics. In the past 24 hours alone, liquidations have played a significant role, with over $126 million in BTC shorts being liquidated. A substantial portion of these liquidations, exceeding $74.6 million, occurred within a mere 12-hour timeframe.

This trend highlights the increasing influence of long-term investors in shaping Bitcoin’s price trajectory. As Bitcoin continues to leave exchanges, the reduced liquidity on trading platforms amplifies the impact of liquidations, contributing to the overall upward momentum in Bitcoin prices.

Conclusion

In conclusion, the surge in Bitcoin prices observed today is a complex interplay of institutional interest, potential ETF approval, reduced BTC supply on exchanges, and the resultant impact on liquidations. While the cryptocurrency market remains inherently volatile, these factors collectively contribute to the bullish sentiment prevailing in the Bitcoin market. As the industry eagerly awaits the SEC’s decision on the spot Bitcoin ETFs, market participants will continue to closely monitor these dynamics, recognizing their role in shaping the future trajectory of Bitcoin prices.